F2N: Narrative Spectrum Investment

An investment and corporate strategy model based on overlapping narratives.

Welcome to my substack where I’ll focus on ideas and trends for technology companies and investors in them. This first post outlines how i’ll be weaving together different insights, delivered in future posts, into an overall model. The model and how we intend to build it, is my overall thesis, if you like.

Last week, my friend Nicolas Colin produced an excellent essay, titled “Late Stage Investment Theory” which delivers a thesis for the structural changes to technology investment from Private Equity to government funding, over the coming decade. I have recently written an oped on the changes to Venture Capital for the asset management publication, Citywire, and I was interviewed about them in last week’s Financial Times piece on the same subject.

These things are very important as they will affect global competitiveness in the age of AI.

I agree with a lot of what Nicolas says, but I have a different view of the underlying framework, and this changes how I think it will play out and how capital should be deployed. This post outlines a different framework at a high level.

Carlota Perez’s Phases of Innovation

The framework that Nicolas uses is based on Carlota Perez’ work which she described in the book “Technological Revolutions and Financial Capital”. This became highly influential in Silicon Valley and underpinned several VC firms’ theses. I’m pretty familiar with Perez and her ideas as when I was at the VC firm, Anthemis, we sponsored her ongoing work.

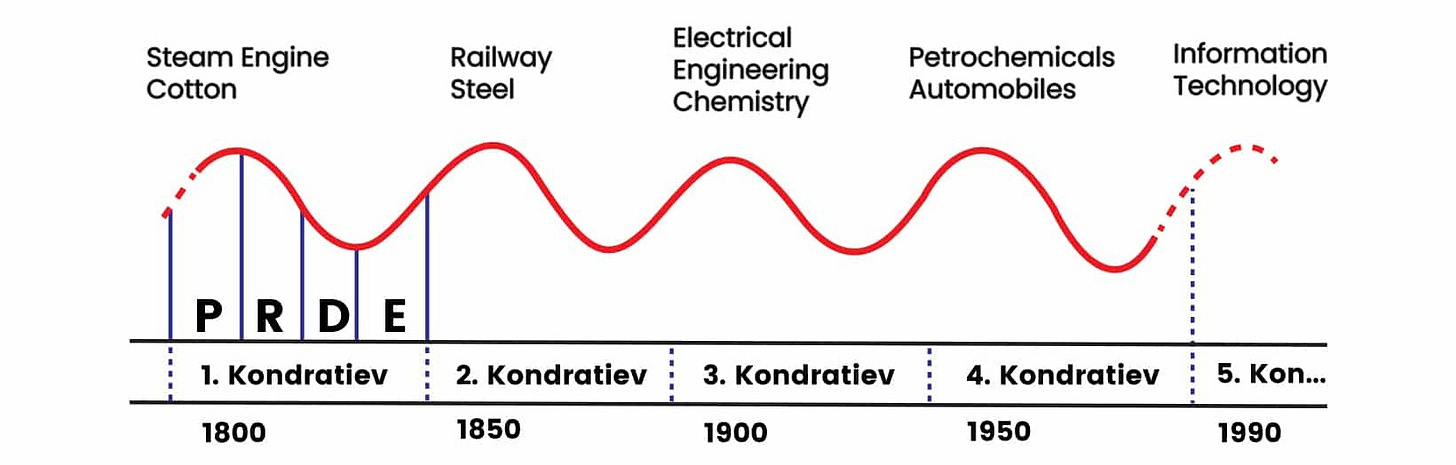

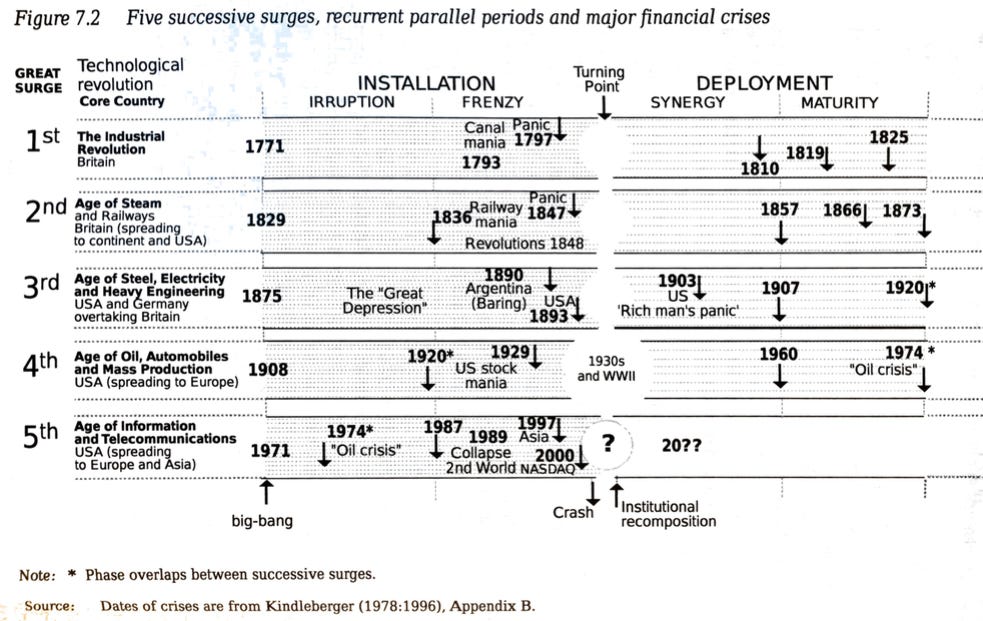

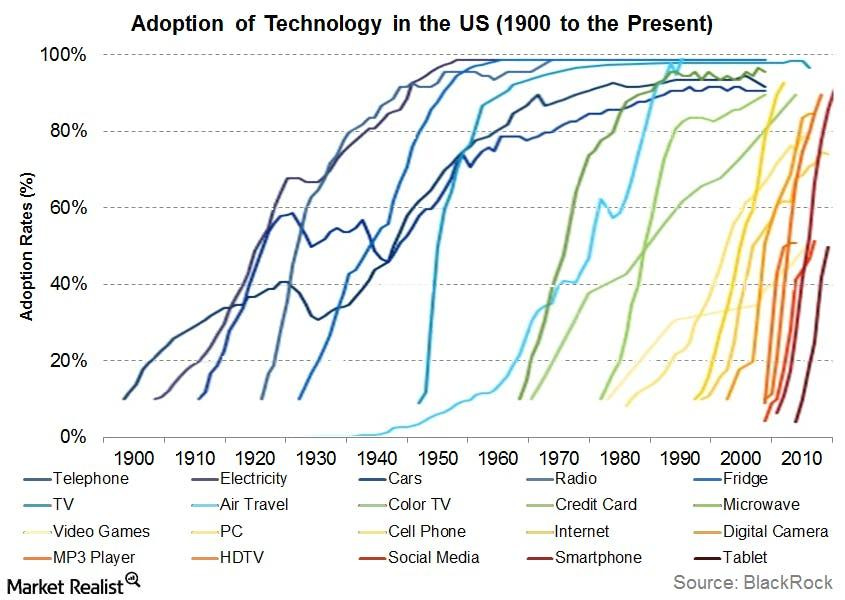

To briefly summarize the Perez model and where it came from, in the 1920s, economist Nikolai Kondratiev identified regular cycles (K-waves) of roughly half a century, in periods of industrial era innovation.

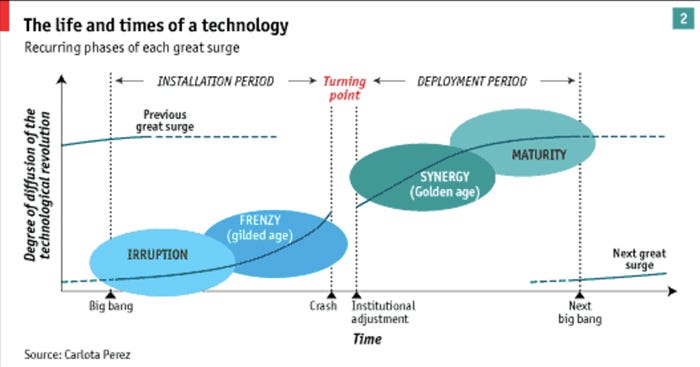

At the turn of the millennium, when the internet revolution was just starting to go mainstream, Perez took Kondratiev’s waves and broke them into two periods of two phases each, allowing for some overlap. This was based on integrating some of Schumpeter’s ideas of the dynamics of innovation & creative disruption and their financing into Kondratiev’s model.

Perez then mapped these onto historical phases (although there is a lot of shoehorning or selective categorization to make them fit, in my opinion):

Colin’s Late Cycle Investment Theory.

Based on Perez’ framework, Nicolas Colin argues that we are now in the latter phase of the digital revolution - the deployment phase, and that is why structural rifts are starting to show in both Venture Capital and Private Equity and why money is increasingly flowing to deep tech and information technology infrastructure projects (AI models, chips, data centers and electricity) that require much larger pools of capital and have different risk profiles.

This shift in capital flows is real and provable and therefore Nicolas’ theory is important, but I believe the reasons for it are different. Although he acknowledges that the deployment phase of a Perez cycle is merely a lens to extract insights from and doesn’t need to be based on hard ground truths, I also believe the lens is flawed and therefore the theory can be refined.

An Adjusted Framework

The framework I propose has five differences:

1. The AI wave is not an extension of the internet one, it makes more sense to look at it as a new one and the overall AI, internet and pre-internet phases of information technology innovation are different from the industrial era cycles.

2. The reason for the shift upstream towards infrastructure and hardware financing is to do with the underlying differences of AI (specifically a shift in network effects from distribution to production).

3. These shifts towards digital era manufacturing mean that the Chinese manufacturing model, which is post industrial and coupled with software, wins.

4. The regular cycles of k-waves are fundamentally wrong, the cycles vary. In the digital era the cycles shortened compared to the industrial age and in the AI era the rate of shortening will accelerate.

5. Overlapping cycles are combined to create something that does not have any overall regularity, but decomposing it to all sorts of different cycles based on different trends and narratives, proves you have the right overall model.

1. AI creates a new major cycle

AI software is different, there aren’t really any ‘algorithms’ at all, in the traditional sense. There is no codified ‘IF This Then That’ logic and the outputs of AI models are statistical, emergent qualities of a network, not deterministic calculus. This fundamental software paradigm shift is why we are in a new wave of innovation as different from the age of steam vs Fordian assembly lines in industrial eras.

2. The shift towards infrastructure and hardware financing is because of AI not a digital era deployment phase.

With AI, the software itself is a network where the software writes software, to the point where this is potentially a runaway effect when AI models build their own successors (the singularity). What this means is the network effects are in the production side since as software writes more software there is a flywheel effect where the cost of production drops (NB, the cost of production drops but the cost of running software, the AI token cost, is significant and this disrupts things like startup freemium models).

The business models of AI are fundamentally different from the internet which has distribution network effects, so the opportunities are at the opposite end of the market. It means that value will flow to deep-tech startups (things based on real science and IP vs distribution advantage), incumbent tech platforms, hardware and infrastructure providers. We may see Corporate Venturing arms of large technbology companies eclipse traditional VC and that strategic financing and possibly pre internet style corporate labs (a new era of Xerox Parc and Bell Labs style entities) will return.

AI companies that are wrappers around LLMs, financed by Venture Capital firms that are applying the internet investment model to AI, will perform badly and cause the number of VC firms to shrink.

In public markets, we have already seen that most of the recent gains in the S&P have been accrued by the tech platforms that are also AI infrastructure providers. A dotcom style correction with continued long term growth could repeat if there is infrastructure over-build, but unlike the dotcom era which collapsed as there weren’t enough users, AI growth seems more robust there. A correction is more likely to be driven by geopolitics and the transition from AI to robotics, where China will have an unfair advantage.

3. The Chinese manufacturing model wins.

This component of the framework is the same as Nicolas’, however I am including it as an item in the amended framework, to illustrate that it appears for different reasons.

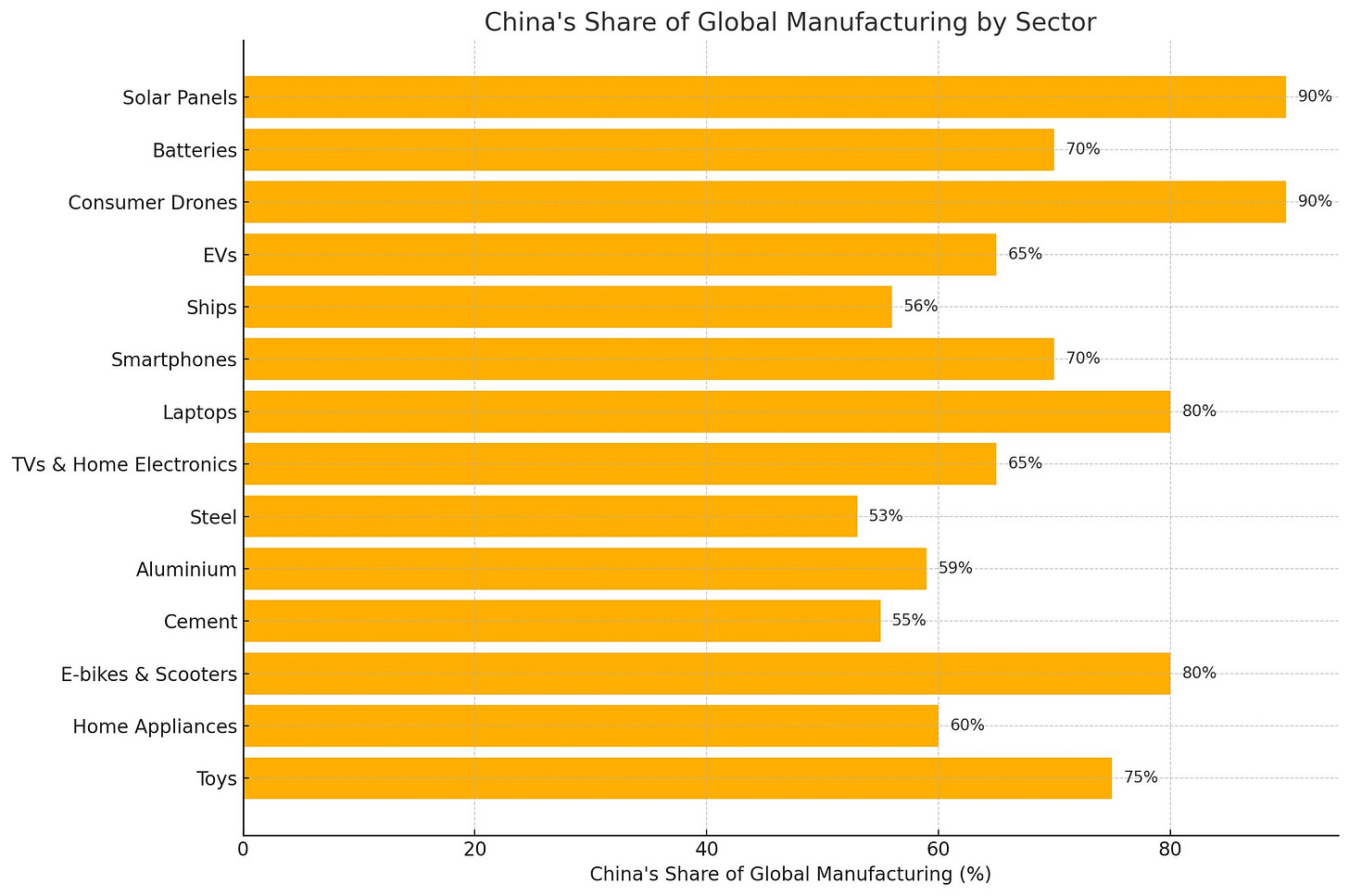

China dominates manufacturing, but specifically it dominates manufacturing of the types of hardware that have embedded software as a core component - these include EVs, drones, smartphones etc. and they form the principal components of the commanding heights of the post industrial economy.

Because manufacturing can never be near zero cost (as it requires physical materials) but software creation in the AI era potentially can, a new model has emerged where software is given away to sell hardware. For example, BYD gives away its self drive software, potentially undermining Tesla’s ability to sell self drive subscriptions and DeepSeek open sources LLMs, copying Meta’s playbook to undermine OpenAI (which is turn was copied from Microsoft giving away the browser to undermine the threat from Netscape in the early days of the web). For Apple, a supply chain management and product design company that is struggling to do either and who have charged a bigger margin than the manufacturer, this model is potentially very threatening - if AI removes their OS moat.

The digital era manufacturing model undermines the digital era services one which in turn created venture backed companies that replaced industrial era ones as the world’s biggest (except for in Europe). In other words, US software was ‘eating the world’, now Chinese hardware is. And just like US digital era software services ate European industrial era services, Chinese, digital era manufacturing, will eat both US and European industrial era manufacturing unless they become highly automated with significant software sophistication.

When this software enabled hardware extends to AI, you get self driving cars and ultimately, general purpose robotics which extend AI agents from the online to the real world. And humanoid, AI robots can be trained on videos of people to do what people do, so they have a bigger addressable market and training network effects. As such, AI robotics is predicted by many (such as Nvidia’s CEO) to be the biggest industrial sector ever, with a market greater than $50 Trillion. The AI arms race will therefore expand from software to hardware and to geopolitics.

4. The regular cycles of K-waves are fundamentally wrong.

Not only is AI a new wave of digital innovation within the prost industrial period, the previous digital era waves were fundamentally different from the industrial era ones.

The PC era lowered the marginal cost of production to zero (an extra Windows CD cost Microsoft pennies) and the Internet era lowered distribution (sales and marketing) costs to zero. Network effects (value to all users increases with number of users) and virality (new users bring more new users) meant that things grew fast and captured entire markets.

Unlike in the industrial era, growth was not linear and so the K-waves were shortened - the deployment phase of the internet isn’t coming only now with AI, it’s been here since the major platforms (GAAFA or Mag 7) came to dominance at the top of the internet food chain, many years ago.

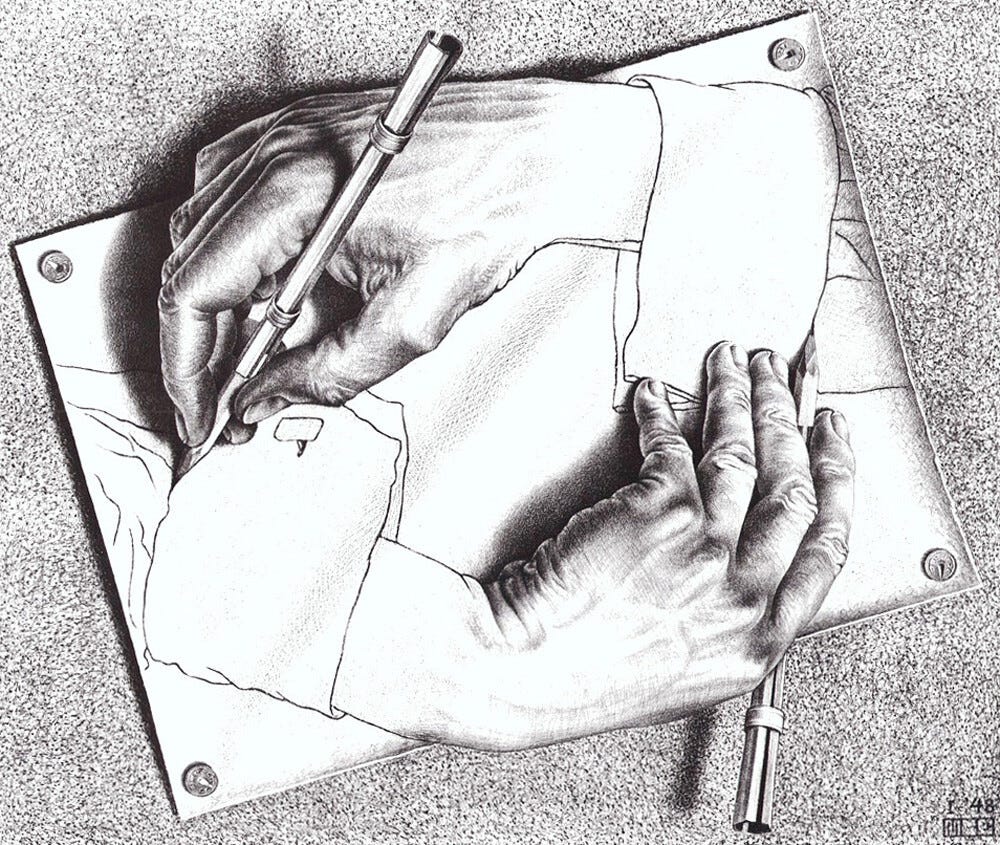

5. Cycles are invisible till they are decomposed.

Music waves and stock market charts in the real world, rarely look totally regular and looking for patterns in the latter is often a fool’s errand. Imposing those patterns on real trends is similarly dangerous.

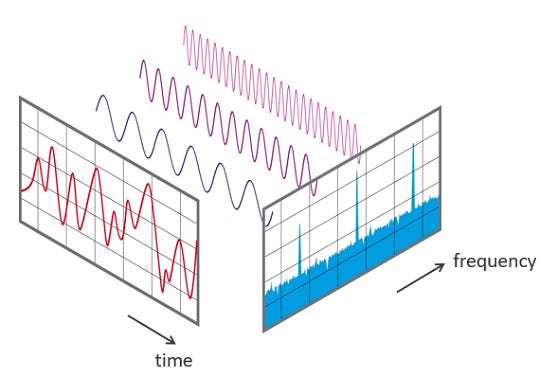

But there is a magical property of messy waves - that they are based on overlapping simple waves that can be mathematically extracted through a Fourier transform. In other words, in the reverse process, if you have an economic model of complex overlapping cycles you can in principal know that your model is correct if their overlap produces cycles that approximate to what is observed in real world messy things like markets.

The idea of “letting the data tell you” what cyclical components live in economic or financial time‐series via Fourier (or related) transforms actually goes back almost a century, where econometricians developed spectral analysis to see which frequencies show up most strongly in the data. Jan Tinbergen was among the first to apply these ideas to business‐cycle data in the 1930s, winning a Nobel for dynamic models of the analysis of economic processes.

Today, many hedge funds use a signal processing approach to quantitative analysis and these emerged from AHL’s development of systematic trading in the 1980s.

Rather than impose “clean” 50 year K-cycles or fixed Perez waves, these firms let the data reveal which frequencies carry the most variance—and then design filters or strategies around those empirically observed cycles.

The difference, however, is that this data is either quantitative data for quantitative analysis or qualitative data for quantitative analysis

There aren’t, to my knowledge, any purely discretionary or thematic hedge funds that take Perez’s narrative-driven waves (e.g. “Internet deployment,” “biotech boom,” etc.) and run a straight Fourier-or-wavelet decomposition on those qualitative time-series. Instead, what you do see is quant shops turning qualitative proxies into numbers.

Firms like Man AHL, Two Sigma, D.E. Shaw or Renaissance will pull in alternative data—Google Trends on “quantum computing,” Wikipedia page-views for “AI” and then treat that as a time-series. Once it’s numeric, they apply exactly the same spectral tools (DFT, band-pass filters, wavelets) to hunt for dominant cycles or regime shifts.

No major discretionary thematic fund publishes a “tech-cycle spectrum”, we plan to. Managers like ARK Invest, Global X, or thematic private-equity firms still base their cycle calls on fundamentals, valuations, adoption curves and expert calls—not on spectral analysis of cycles.

Conclusion: ‘Narrative Spectrum Investment.

The current combination of geopolitical and technological shifts are on a scale that we haven’t seen in centuries, so the underlying thematic trends dominate everything in terms of investment. There is a shift from quantitative to qualitative corporate strategy or investment advantage.

At the same time, fundamentals don’t matter as much or don’t provide opportunities for ‘alpha’ (investment advantage). Sell side analyst reports are often low quality even if packed with data, high frequency trading is a race to the bottom and narratives both real and imagined (meme trading) dominate both public and private market investment.

Rather than imposing a single frequency as a lens to extract a narrative as Perez does, analysing frequencies to extract narratives and their degree of influence, potentially allows for a degree of objectivity in thematic investing.

Making sense of this through signal processing approaches to qualitative thematic information by spotting trends and opportunities for everyone from Private Equity to hedge funds would be a core component of AI era rather than late stage, investment theory based on a narrative spectrum rather than k-waves.

In other words, if you find the overlapping narratives that constitute a model that is backtestable to some ground truths, you can predict future scenarios and invest in them. If you understand the spectrum of both fictional and real narratives you can predict things.

We will attempt to deliver the ‘tech-cycle spectrum’ and what will follow on this substack will be narratives that describe current trends and future scenarios that we will attempt to piece together into a combined model, over time.

For the moment the substack will be free but access to the overall data, repurposed and combined with your own, in an AI model with interfaces designed by us, can be provided on a retainer basis. If you are interested, ping me: david@f2n.co