The Socio-economic Model of the AI Era, Part 1: The Internet

The Internet: communication becomes a network.

I’ve compiled a single presentation that condenses pretty much every component of my world view, showing what the underlying model of the post-industrial era is and how it will evolve in the AI one. Each slide is basically a bullet point and diagrammatic tl;dr of a thesis that forms a component of the whole.

Over the next few weeks, I’ll release the principal components of it with some explanation. Below is the description of the Internet component, what the principal innovation the internet brought and how it was different.

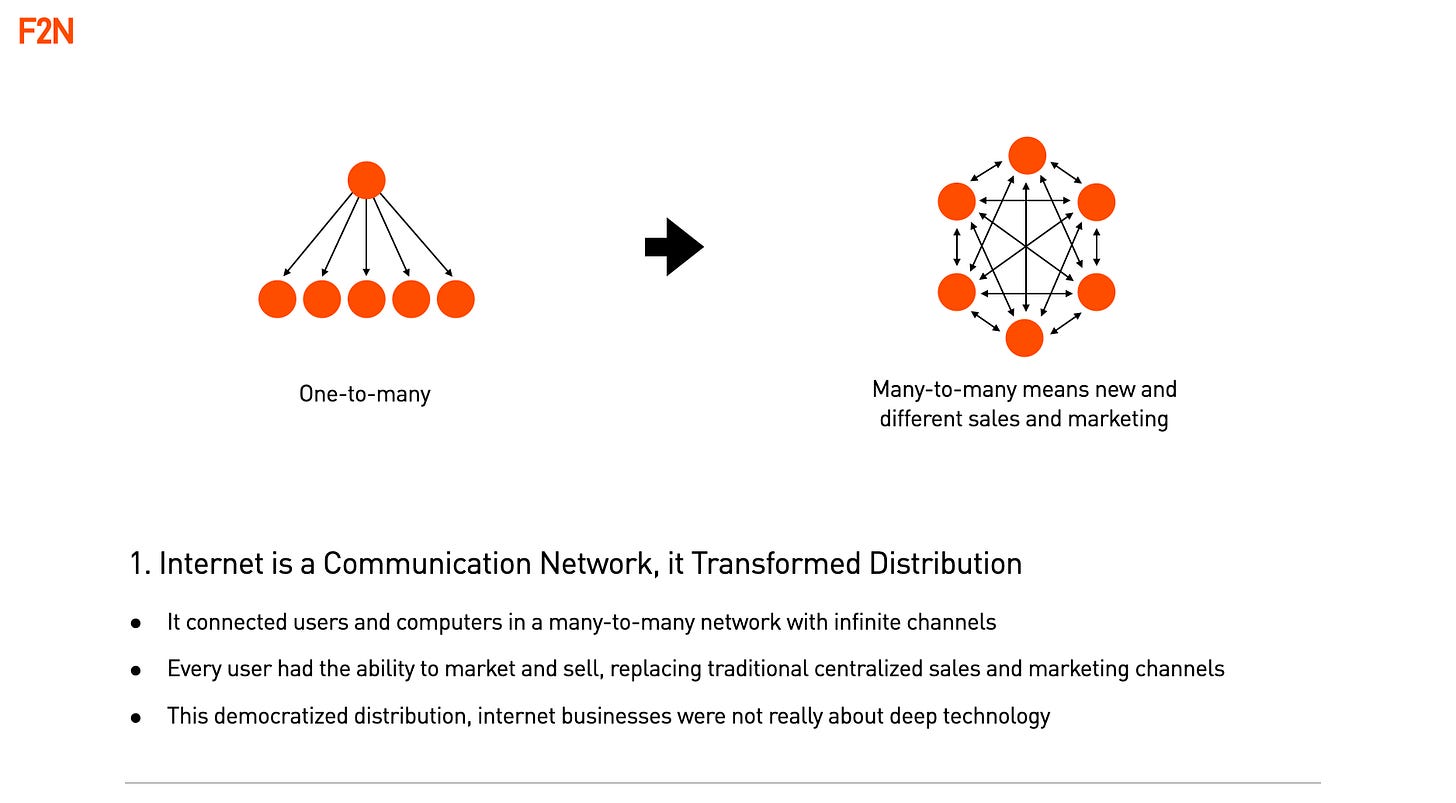

The internet created a meta network that allowed computers, computer networks and their users to join a single global one, without permission and the principal thing this delivered was a communication system where there were infinite channels.

In the broadcast era, few people owned the principal communication channels, from newspapers to TV or radio stations, and the dissemination of information was one-to-many. What the internet did was allow for many-to-many communication - anyone could publish a website and anyone could visit it.

In business terms, this transformed distribution or sales & marketing, replacing it with something completely new and far more trackable. The single biggest misconception about successful internet businesses is that there were about new technology - they were mostly about marketing, but marketing that required internet native understanding.

One of the more ironic things I’ve witnessed in my career is that non technical investors in internet businesses tended to over invest in technology, precisely because they were non digital natives and didn’t see the difference between ‘deep technology’ (the kind of thing that comes out of university research and has patents) and tech savvy distribution with commodity technology.

Most internet platforms were build on deep understanding of internet era distribution and leveraged commodity technology such as open source operating systems, server and database software. On the other hand, most genuinely deep tech companies in the early internet era were based on innovations that were too early to go to market.

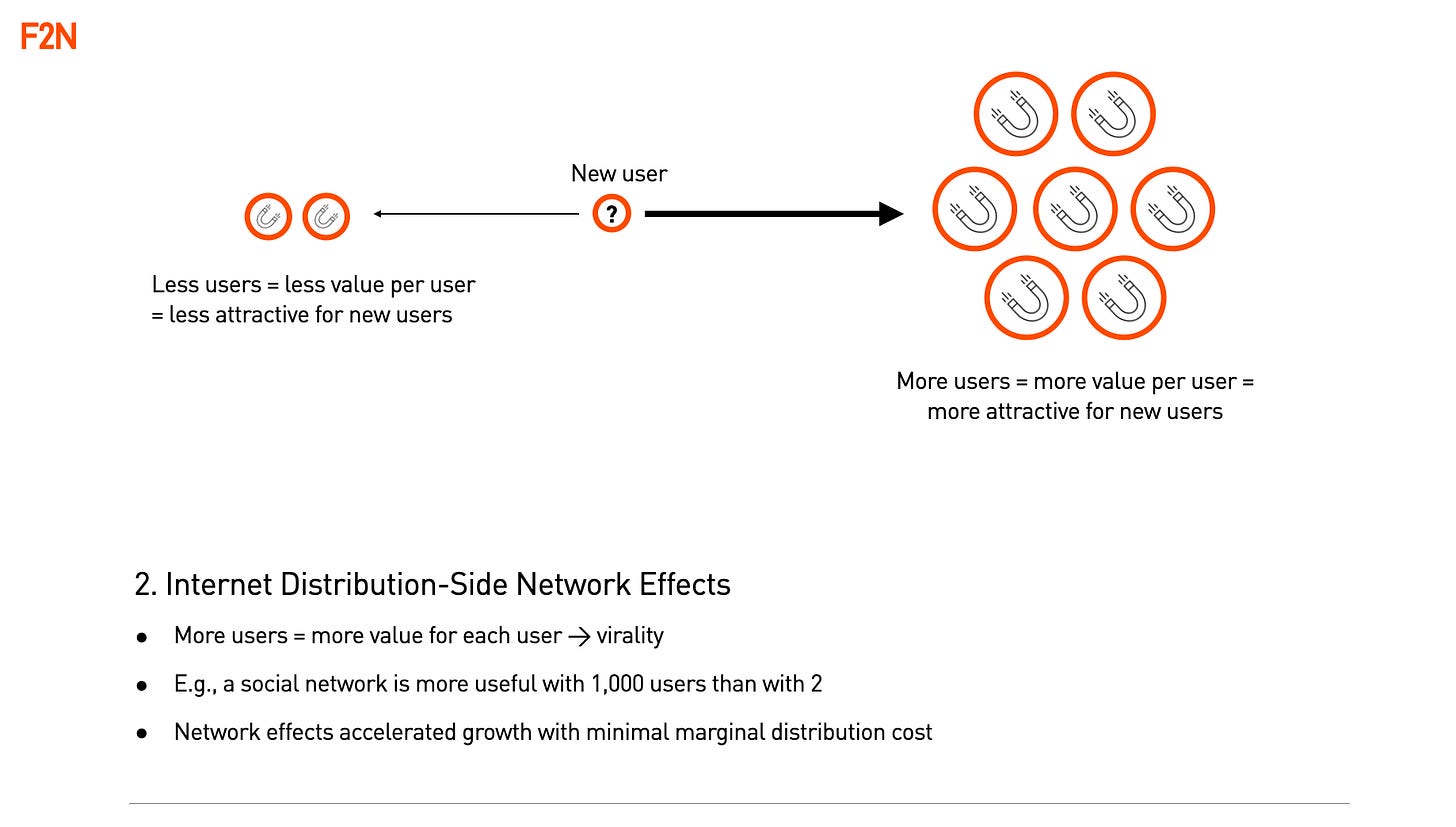

In summary, the internet created distribution-side network effects or, more accurately, network benefits. Network benefits comprise network effects and virality, where each has a specific meaning. A network effect is where the value for each user increases with total users (a social network with a couple of users is less valuable for both than one with many) and virality is where each new user brings more than one new user, creating non linear growth.

Since greater value and more users create more awareness and attractiveness, network effects create more virality which creates increased network effects, and so on, for a flywheel of growth. Because it was a communication network innovation, the internet made scientific business growth a reality.

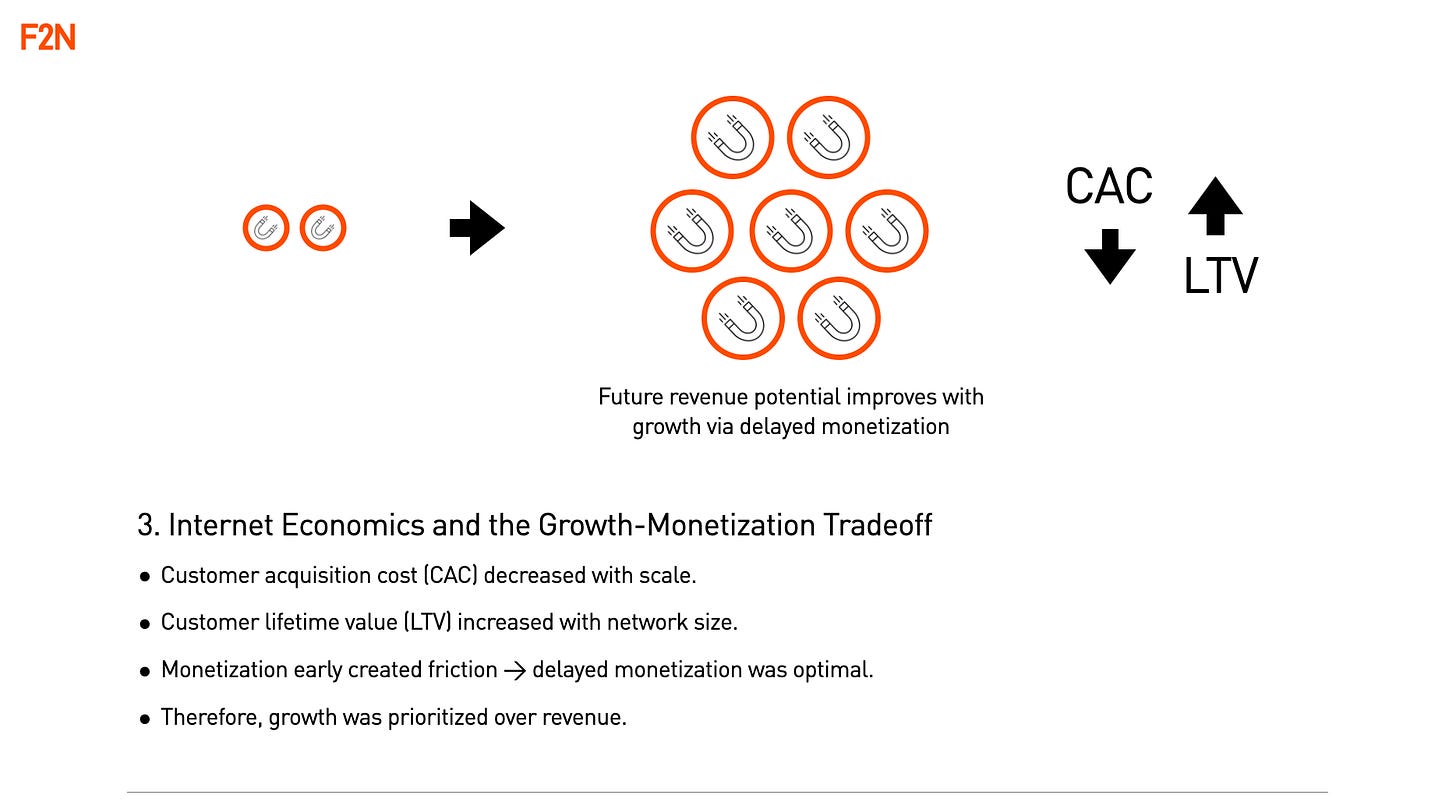

Internet growth metrics could be mapped directly to business model unit economics since increased virality meant that Customer Acquisition Costs dropped the bigger you grew while potential Customer Lifetime Value increased.

I deliberately say ‘potential’ customer lifetime value as realising that value by forcing people to pay up front or early, would increase Customer Acquisition Costs and slow growth, the optimal solution was to delay monetizing users and grow faster than all competitors to capture a market.

The internet created winner takes all markets for those that could delay monetization and focus on growth alone.

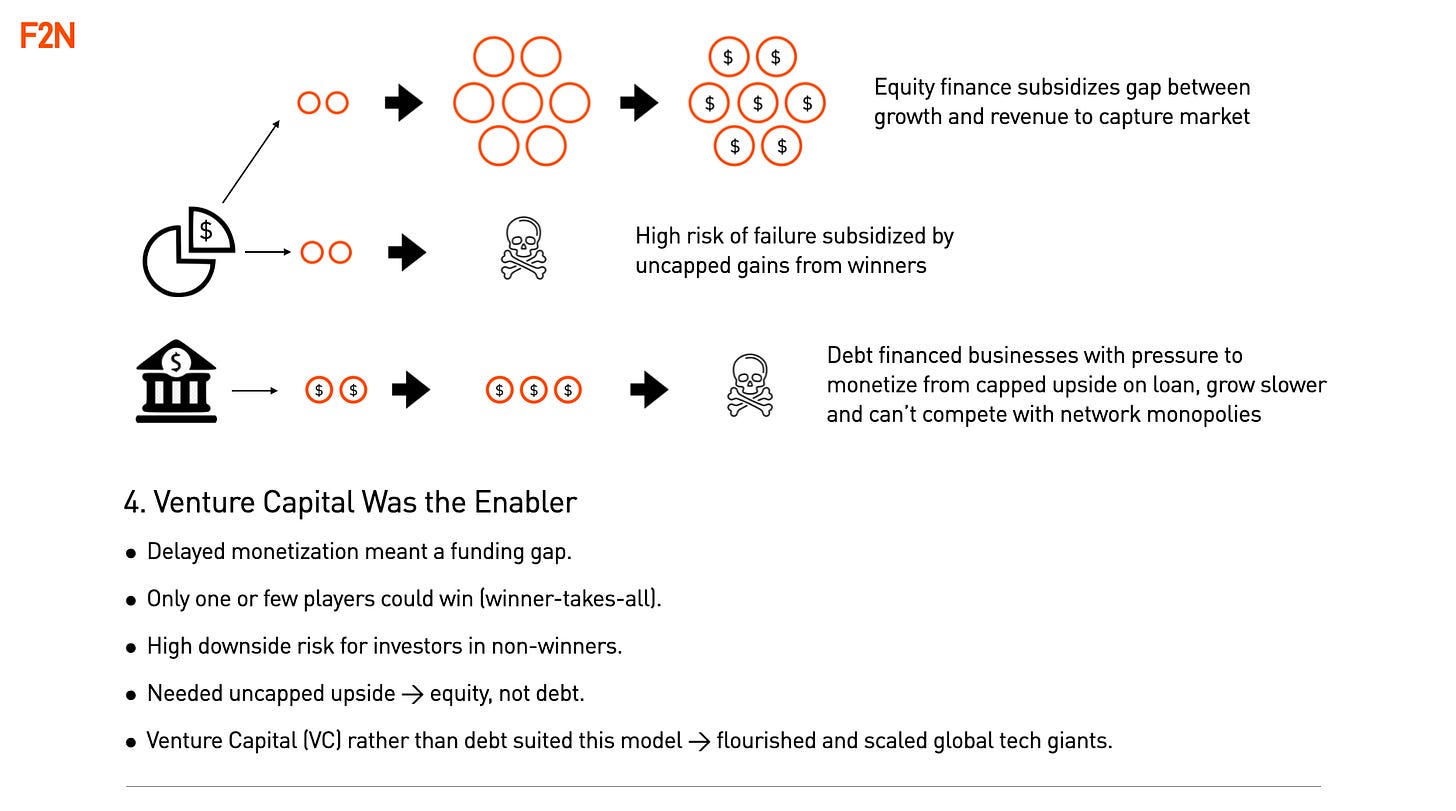

The problem with this growth-before-revenue model was that it required subsidy and the problem with that subsidy being in the form of a traditional bank loan was that internet businesses were a race with one winner and lots of losers. This made them too high risk for debt financing as there was too much downside and a fixed upside.

Venture Capital had existed for decades but only really took off as an asset class with the advent of the web. After a false start (dotcom crash) based on insufficient users to match supply, the rise of internet enabled smartphones created ubiquitous internet connectivity and giant businesses. By taking equity, upside was uncapped and this mitigated the downside risk, allowing for the winners, who had spectacular returns by capturing entire markets, to subsidise the losers.

Just as less tech savvy investors ironically invested in technology, less tech savvy investors often invested in companies that looked like they would at least make some money even if they didn’t aim to capture entire markets with the accompanying significant risk of failure. Because network benefits were at play, Venture Capital was based on returns with Pareto distributions (a form of power law) and successful VC funds only worked if EVERY investment was a potential unicorn.

A back of envelope calculation shows this: a winning investment, which will end up being a less than 10% stake has to ‘return the fund’ (say $100M) so it has to be worth $1 billion+.

Even more dramatic than this is the fact that distribution amongst VC funds themselves follows a similar power law where, as a whole, VC doesn’t really outperform public market indexes where investment isn’t locked in for a decade. The Venture backed investment ecosystem is fractal - the winning companies in the winning funds account for the majority of returns.

Despite these odds, Venture Capital backed internet platforms replaced industrial era firms to became the world’s largest companies, all because of the structural dynamics of network distribution.

As with all progress, there are benefits and downsides, and the early days of the web were full of utopian optimism that was later to be dampened as cyber vulnerabilities, misinformation and tribal political battles were waged on the internet.

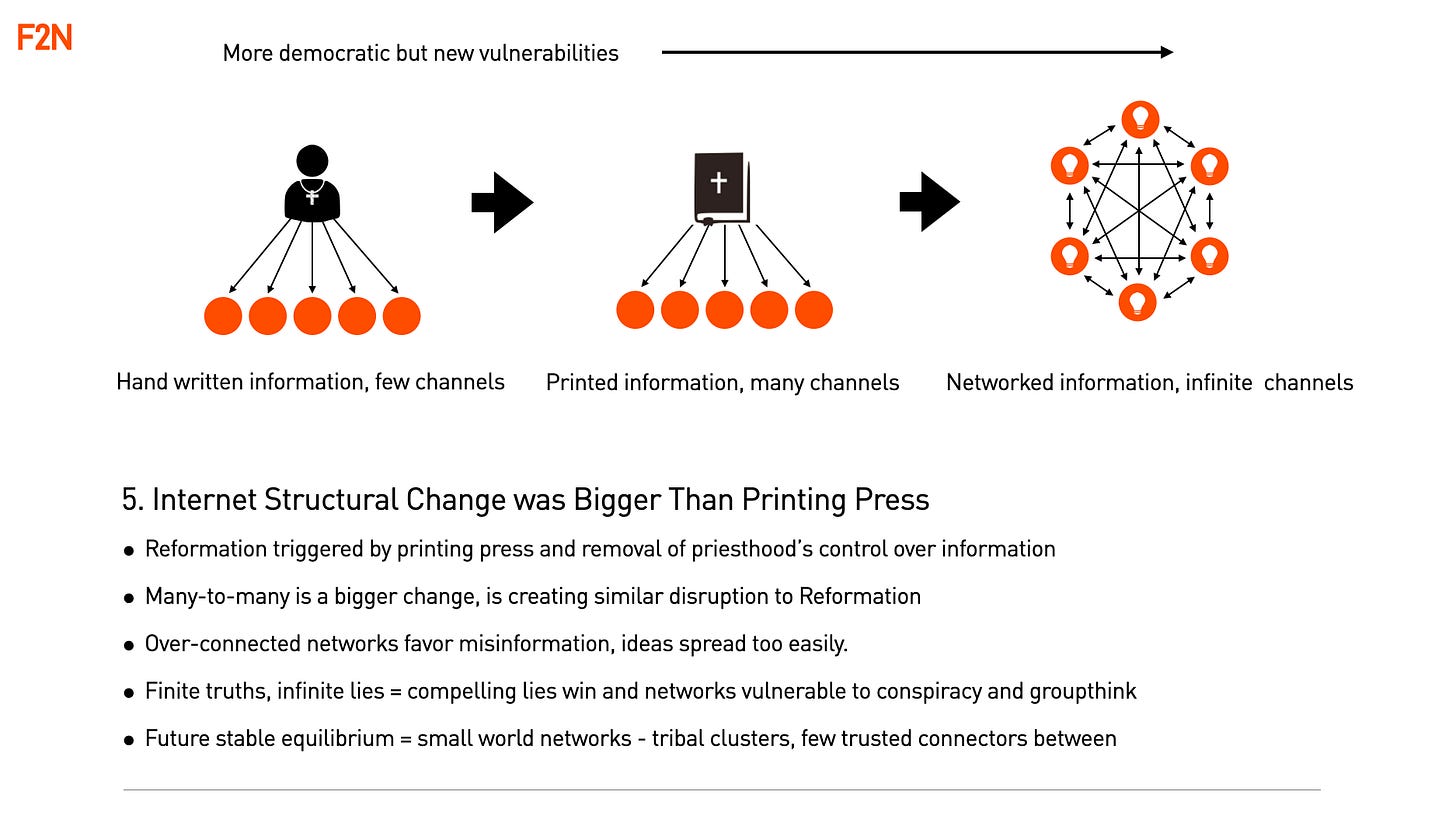

This should have been no surprise. The structural change in human communication from one-to-many to more-to-many that the invention of the printing press brought about is far less than a shift to many-to-many. But the printing press’ challenge to the Christian priesthood’s dissemination of information in Europe triggered the Reformation and more than a century of conflict, resulting in the birth of the modern nation state once things reach a stable power equilibrium again.

What we are currently going through, from the rise of populism, culture wars and cyber attacks is a product of the structural changes to the flow of information brought about by the internet and it would be naive to think that the effects will be less dramatic than the Reformation.

However, just like solving for internet growth was based on structural principles of networks, the solution to internet societal disruption is also based on network science.

Over connected networks have a particular characteristic - things spread wherever there is a link. In networks such as this, disease spreads instantaneously and the same is true for memetics to genetics. Ideas in overconnected networks spread quickly and since there are an infinite number of lies and a finite number of truths, there are more compelling lies than truths and lies win.

In terms of network software vulnerabilities there is also a factor of ‘technical debt’ ie lazy coding delivers quick results with long term vulnerable spaghetti code (debt), which when coupled with network interconnectivity means that cyber vulnerability grows over time as the attack surface becomes enormous.

The solution to both problems is in network topology, specifically, a goldilocks zone where networks are neither over connected ot not connected enough, called a small world network. What this looks like is clusters of connection with only a few links between the clusters.

This, more balkanized but still linked, version of the internet than the vast, over connected plains of much of social media is what is necessarily required for a stable societal equilibrium in the network era. It is the network equivalent of the physical topology of the post Reformation city state and hopefully will not follow decades of religious wars.